If you operate a machine shop and are involved with lathe operations, you may be unaware that many of the activities you undertake could qualify for R&D Tax Credits. These credits were designed to promote and reward innovation and can provide significant financial benefits for companies, including those in the machining industry.

Elevating Precision with R&D Tax Credits

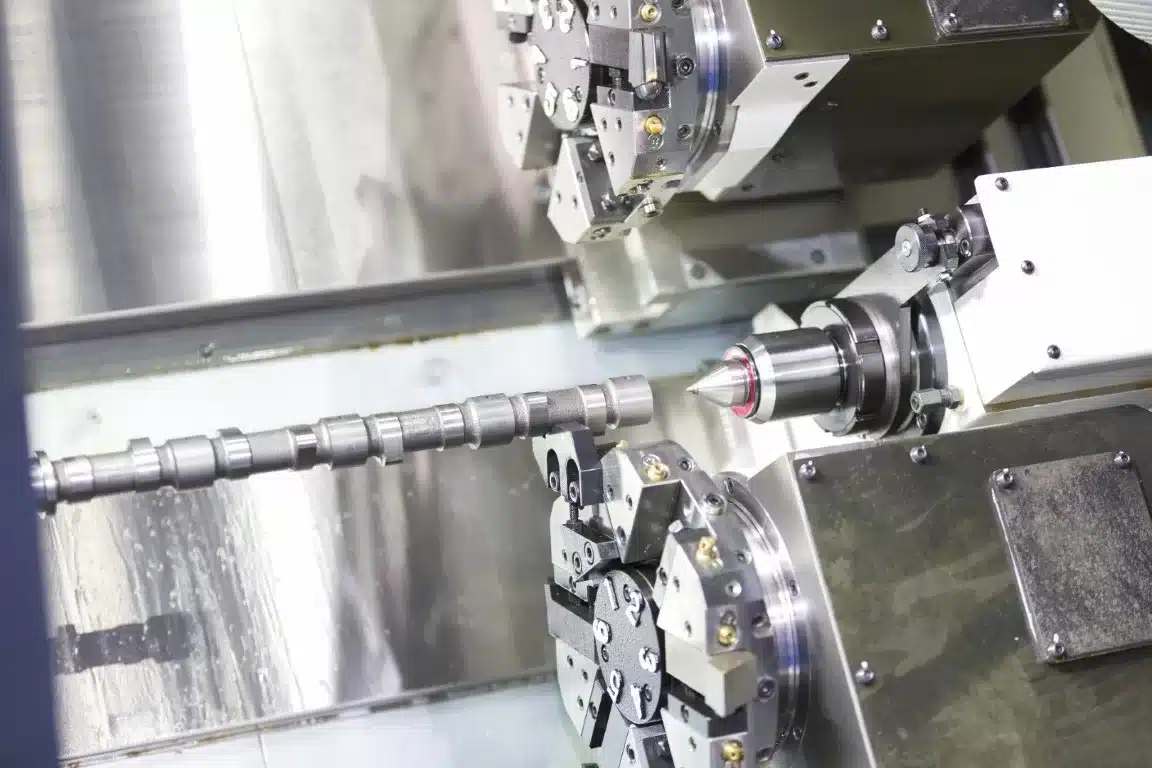

Lathe operations are a critical component of machine shops, with many tasks involved in this process potentially qualifying for R&D tax credits. For instance, developing new or improved techniques for turning processes can be an eligible activity. This can include methods to improve precision, enhance tool life, or increase production speed.

Innovative Tooling and Fixtures

Another area of potential eligibility is the design and development of innovative tooling and fixtures. If your machine shop is investing time and resources into creating bespoke tooling or fixtures to meet the specific needs of a project, this can be considered for R&D tax credits.

I imagine a world in which AI is going to make us work more productively, live longer, and have cleaner energy.

– Fei Fei Li, Director of Stanford’s Artificial Intelligence Lab

Programming for Complex Parts

The programming required for turning complex parts on a lathe can also fall under R&D. If you are developing new or improved software, or modifying existing programs for better performance, these activities could be eligible.

Advanced Material Testing

The testing and experimentation with different materials to achieve desired properties is an integral part of lathe operations. If you are involved in testing new materials or methods to improve the quality of your products, this can be considered R&D.

R&D Tax Credits and Automation

While traditional manual methods to prepare and support R&D Tax Credit claims are still used, automation is increasingly being applied. This shift can make the claiming process more efficient, accurate, and less time-consuming for machine shops. Even if your shop hasn’t fully embraced automation yet, the activities related to developing and implementing these automated processes could potentially qualify for R&D credits.

Your R&D Tax Credit Awaits

If you are engaged in any of these activities, you could be leaving money on the table. By leveraging R&D tax credits, machine shops can reinvest in their operations, fueling further innovation and growth. Don’t miss out on this opportunity! Click the button below to get an estimate of how much your R&D Tax Credit could be.

- EN

- EN  - EN

- EN