In today’s competitive manufacturing environment, machine programming plays a crucial role in the success of any machine shop. Not only does it help in creating high quality products, but it also aids in optimizing operations and reducing costs. Consequently, this area of work is often a key focus for R&D activities. But did you know that the time spent on machine programming can be covered by the R&D Tax Credit? This article will explore this little-known aspect of R&D tax credits, and how it can significantly boost your bottom line.

R&D Tax Credits A Brief Overview

R&D tax credits are a government incentive designed to reward U.S. companies for investing in innovation. They apply to a broad range of activities, and can be a real boon for machine shops engaged in research and development. Importantly, the credit can be used to offset income tax liabilities or, for eligible small businesses, against payroll tax liabilities.

Machine Programming as a Qualifying R&D Activity

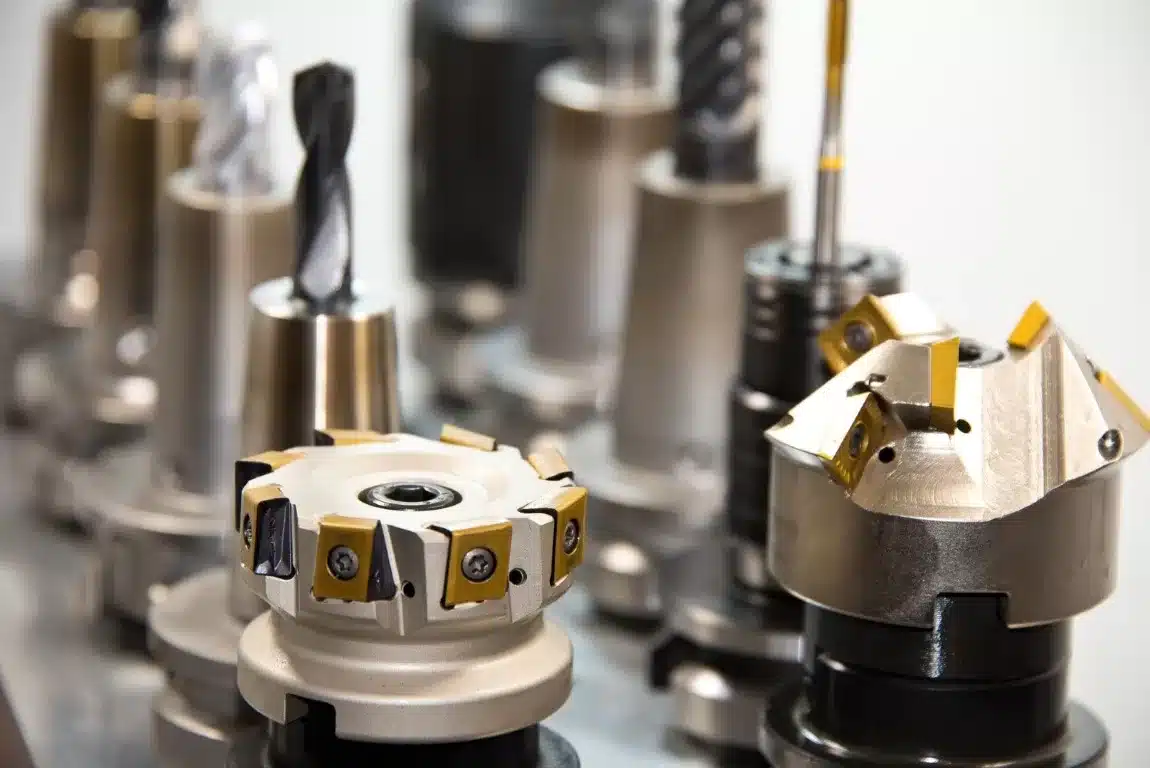

Machine programming is a complex task that often involves problem-solving, experimentation, and the development of new or improved business components. It usually meets the four-part test for R&D tax credit eligibility, which includes: technological in nature, elimination of uncertainty, process of experimentation, and qualified purpose.

“Automation is driving the decline of banal and repetitive tasks.” —Amber Rudd

The Role of Engineers and Technicians

Engineers and technicians play a crucial role in machine programming. They’re responsible for developing and refining the code that runs the machines, testing new solutions, and troubleshooting any issues. Their work is often innovative and involves a high degree of uncertainty – two key criteria for R&D tax credit eligibility.

How AI and Automation are Revolutionizing R&D Tax Credits

The process of claiming R&D tax credits has been greatly simplified and made more efficient through the use of AI and automation. For instance, sector-specific Language Learning Models (LLMs) can be used to identify eligible activities, describe technical uncertainties faced, and outline technological advancements gained. This ability to accurately track and document R&D activities not only reduces the time load for employees but also increases the precision of the claim, maximizing the potential credit.

Maximizing Your R&D Tax Credit

To make the most of the R&D tax credit, it’s crucial to accurately track and document all qualifying activities, including machine programming. Remember, even if an experiment fails or doesn’t result in a new product or process, the time and resources spent may still qualify for the tax credit.

Conclusion Uncover Your Hidden Profits

It’s time to stop viewing your machine programming time as just another cost of doing business. With the R&D tax credit, you can turn this expense into a significant source of savings. Interested in finding out how much your R&D Tax Credit could be? Click the button below for an estimate.

- EN

- EN  - EN

- EN