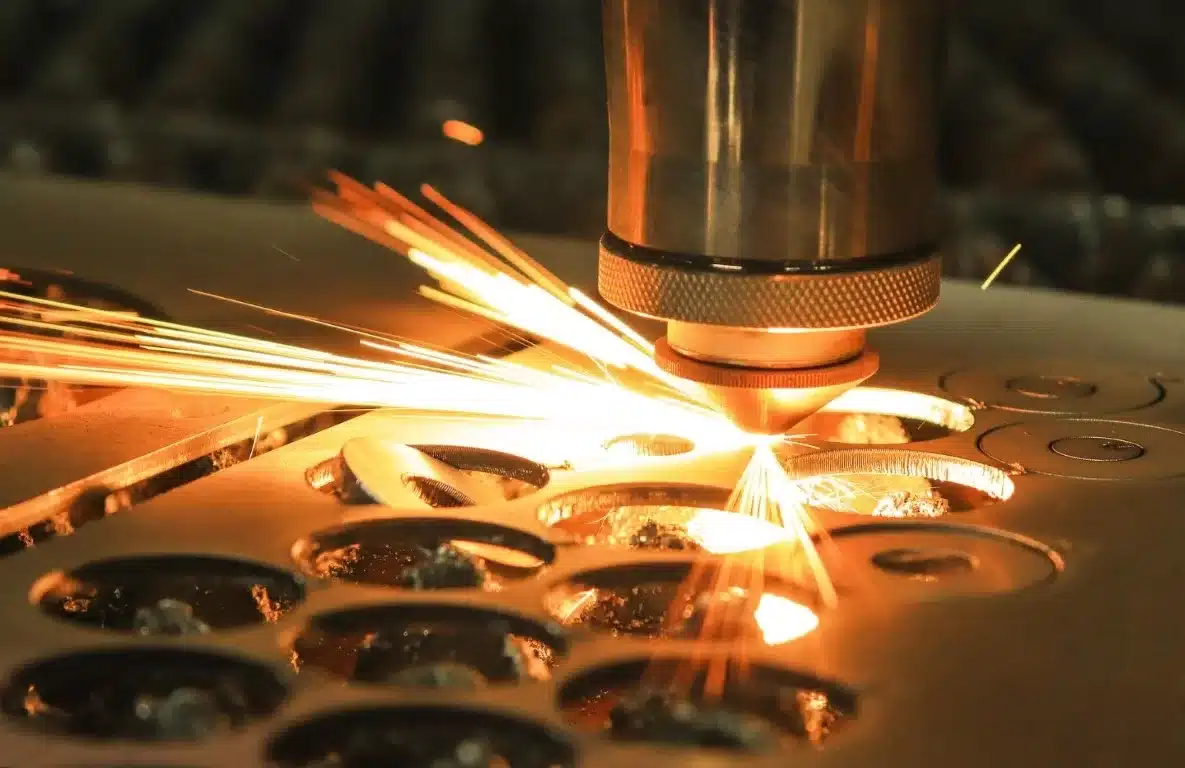

Additive manufacturing, more commonly known as 3D printing, has revolutionized the way industries operate. With its potential to create complex structures using less material and in less time, it’s no surprise that businesses are investing heavily in this technology. But did you know that your efforts in research and development (R&D) in this innovative field can also be financially lucrative through R&D Tax Credits?

Understanding R&D Tax Credits in Additive Manufacturing

The R&D Tax Credit program was designed to encourage innovation and technological advancement in the United States. If your business is involved in any form of tooling or machining operations, including 3D printing for example, and is continuously working to improve the processes, designs, or materials used, you may be eligible for substantial refunds. In the realm of additive manufacturing, activities like developing new 3D printing techniques, experimenting with different materials for improved product performance, or enhancing the software for better precision and accuracy can all qualify for R&D Tax Credits. These tax credits can be used to offset income tax liability, providing significant cash flow benefits for your business.

Harnessing AI for R&D Tax Credit Claims

Artificial Intelligence (AI) has permeated many aspects of our lives, and the field of R&D Tax Credit claims is no exception. AI is now being used to facilitate and automate the claiming process, making it faster, more precise, and less burdensome for businesses. Trained Learning Logical Machines (LLMs) are AI-powered systems that can identify eligible activities, understand the technical uncertainties faced, and spot the technological advancements gained in your 3D printing projects. These LLMs are sector-specific, meaning they understand the nuances of additive manufacturing and can accurately track your qualified research expenses and activities. Not only does this eliminate the time-consuming task of manually tracking project progress, but it also reduces the chance of errors. With LLMs, you can be confident that all your eligible activities are accounted for, increasing your potential tax credit.

“Some people call this artificial intelligence, but the reality is this technology will enhance us. So instead of artificial intelligence, I think we’ll augment our intelligence.” – Ginni Rometty

The Future of R&D Tax Credits

The inclusion of AI in the R&D Tax Credit claiming process signifies a new era in tax consultation. It replaces traditional, higher-cost methods with a more streamlined, precise, and cost-effective solution. No longer will businesses have to worry about the extensive paperwork, time, and resources required to claim their due credits. With LLMs and AI, the future of R&D Tax Credits has never been brighter.

Estimate Your R&D Tax Credit

Now that you understand the potential financial benefits of your additive manufacturing projects, it’s time to take action. Find out just how much your R&D Tax Credit can be by selecting the button below. The future of your business could be just a click away!

- EN

- EN  - EN

- EN