The world of machine shops is evolving. Companies are continuously exploring new methods, materials, and processes to improve accuracy and efficiency. One of the ways forward-thinking machine shops are achieving this is through high tolerance trials. These trials not only lead to innovative breakthroughs but also provide an avenue for companies to leverage R&D tax credits.

High Tolerance Trials The Path to Innovation and Tax Savings

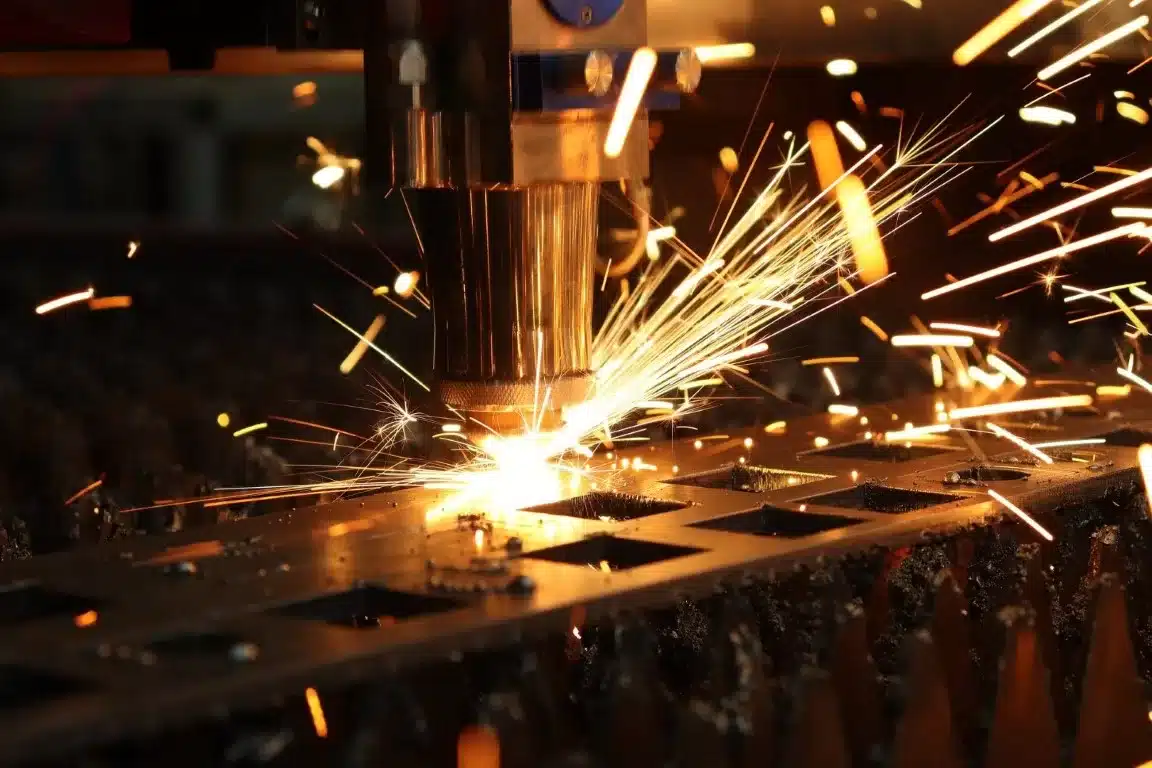

High tolerance trials represent the challenging process of achieving exceptional precision in manufacturing components. These trials often involve testing new machining techniques, experimenting with novel materials, and innovating processes to achieve unprecedented levels of precision. The objective is to reduce waste, enhance efficiency, and ultimately, create better products. However, what many machine shops may not realize is that these high tolerance trials can qualify for R&D tax credits.

Leveraging High Tolerance Trials for R&D Tax Credits

R&D tax credits are a government incentive designed to encourage companies to invest in research and development. Machine shops conducting high tolerance trials are essentially involved in R&D activities, as they are continually improving and developing their processes. These trials often involve resolving technical uncertainties and seeking technological advancements—key criteria for R&D tax credit eligibility.

“Robots are not going to replace humans, they are going to make their jobs much more humane. Difficult, demeaning, demanding, dangerous, dull – these are the jobs robots will be taking.

– Sabine Hauert, Associate Professor of Swarm Engineering at the University of Bristol

The Four Part Test Identifying Eligible Activities

To qualify for R&D tax credits, activities must pass a four-part test. First, they must be technological in nature. Second, they must be undertaken to eliminate uncertainty. Third, they must involve a process of experimentation. Lastly, the purpose of the project should be to create a new or improved business component. High tolerance trials in machine shops often meet these criteria, making them potentially eligible for R&D tax credits.

Automating and Facilitating R&D Tax Credits

Traditionally, preparing and supporting R&D tax credit claims has been a manual process, often requiring significant time and resources. However, the advent of AI and automation has transformed this process. Today’s advanced systems can identify eligible activities, track qualified research expenses, and even assist in writing detailed technical reports. This technology not only simplifies the process but also increases the precision of claims, reducing the likelihood of errors.

Get Your Estimate Today

Claiming R&D tax credits can lend a significant boost to your company’s financial health. If your machine shop is conducting high tolerance trials, it’s worthwhile to explore your eligibility for these credits. By clicking the button below, you can get an estimate of your potential R&D tax credit. Remember, every innovation counts!

- EN

- EN  - EN

- EN