Material Testing A Key Activity for R&D Tax Credit Eligibility

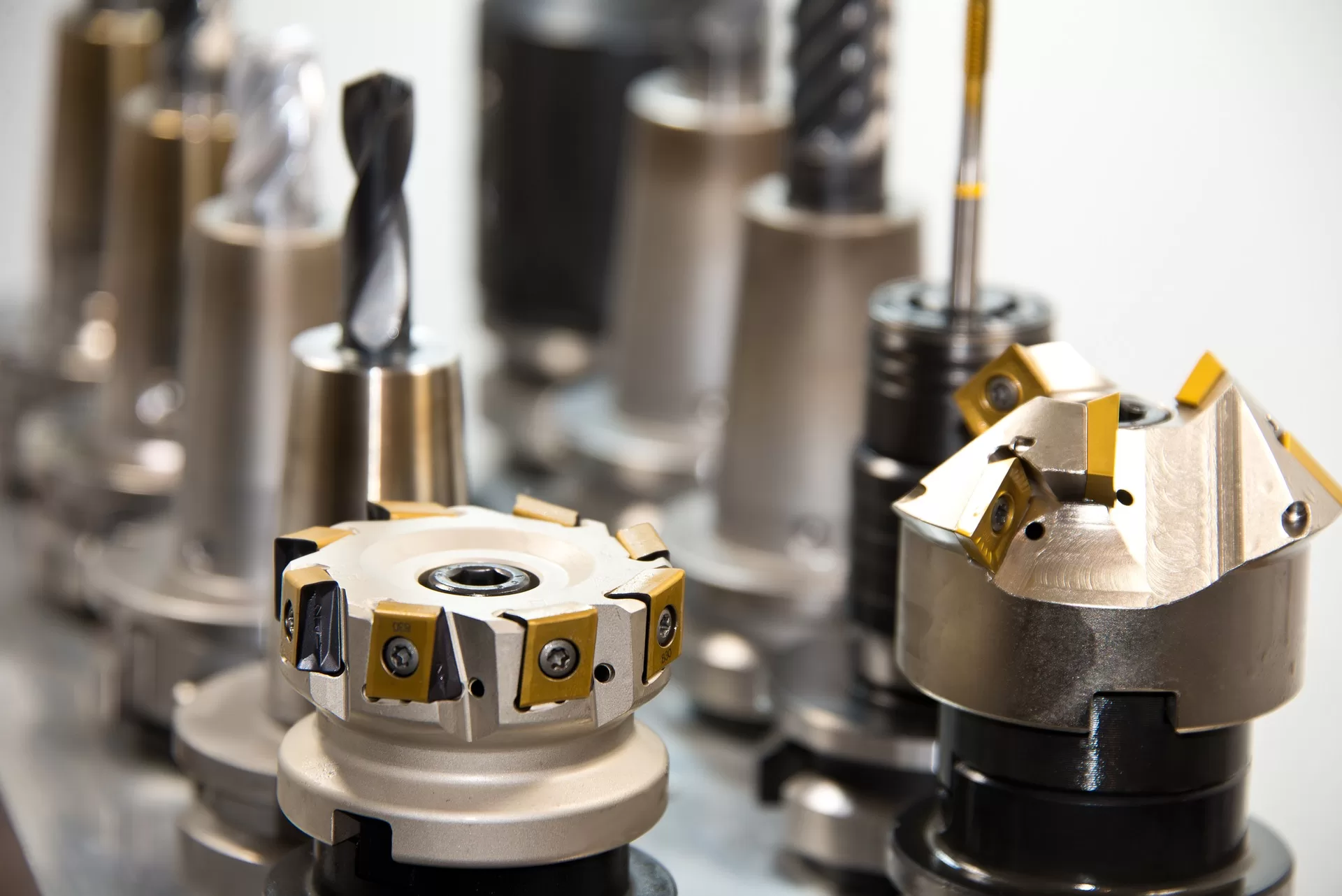

In the world of manufacturing, material testing is a crucial component of the process. It involves determining the properties, behaviors, and defects of materials before they are used in production. This process is essential for ensuring high-quality products, reducing waste, and improving efficiency. As such, it falls within the scope of research and development (R&D) activities that are eligible for the R&D tax credit.

R&D Tax Credit A Boon for Machine Shops

The R&D tax credit is a government initiative designed to encourage innovation in the United States. It provides a significant financial benefit to companies that engage in qualifying R&D activities, including machine shops. By applying for R&D tax credits, machine shops can offset their tax liabilities and reinvest the savings back into their business.

Automation & AI Modernizing R&D Tax Credit Claims

In the past, claiming the R&D tax credit was a cumbersome process that requires extensive documentation and a thorough understanding of tax laws. However, the advent of automation and artificial intelligence (AI) has transformed the way these claims are prepared. Today, AI can be used to automate the process, making it faster, more accurate, and less prone to human error. AI technology can be trained to identify eligible activities, such as material testing, that meet the four-part test for R&D tax credit qualification.

These activities must be technological in nature, involve the elimination of uncertainty, incorporate a process of experimentation, and be intended to create a new or improved business component. By using AI, machine shops can track their qualified research expenses, manage their time surveys and employee activities, and automatically capture eligible activities in their project management, ERP, and accounting systems. This not only saves time but also increases the precision and reliability of the claims.

Increasingly, organizations combine AI with performance data to generate and refine key performance indicators, both with and without human intervention.

– MIT Sloan Management Review

The Future of R&D Tax Credits

With the help of AI, machine shops can now prepare R&D tax credit claims with less time and with increased support documents. This not only reduces the workload for employees but also increases the accuracy and efficiency of the claims. The future of R&D tax credits is indeed bright with the integration of AI and automation.

Getting Your R&D Tax Credit Estimate

If you are a machine shop engaging in R&D activities like material testing, it’s time you considered claiming the R&D tax credit. To find out how much your R&D tax credit could be, simply click on the button below.

- EN

- EN  - EN

- EN